China is actively pursuing certification from American and European regulators for its domestically built passenger jet, the Comac C919. Approval would allow the plane to be operated internationally alongside aircraft from incumbent manufacturers like Boeing and Airbus that dominate global commercial aviation.

But even with foreign certification, it’s unclear whether airlines outside China will ever add this new plane to their fleets. In this piece, I want to briefly discuss the odds that Beijing’s ambitions to compete with the top aviation players will ever truly take flight.

Background on the Comac C919

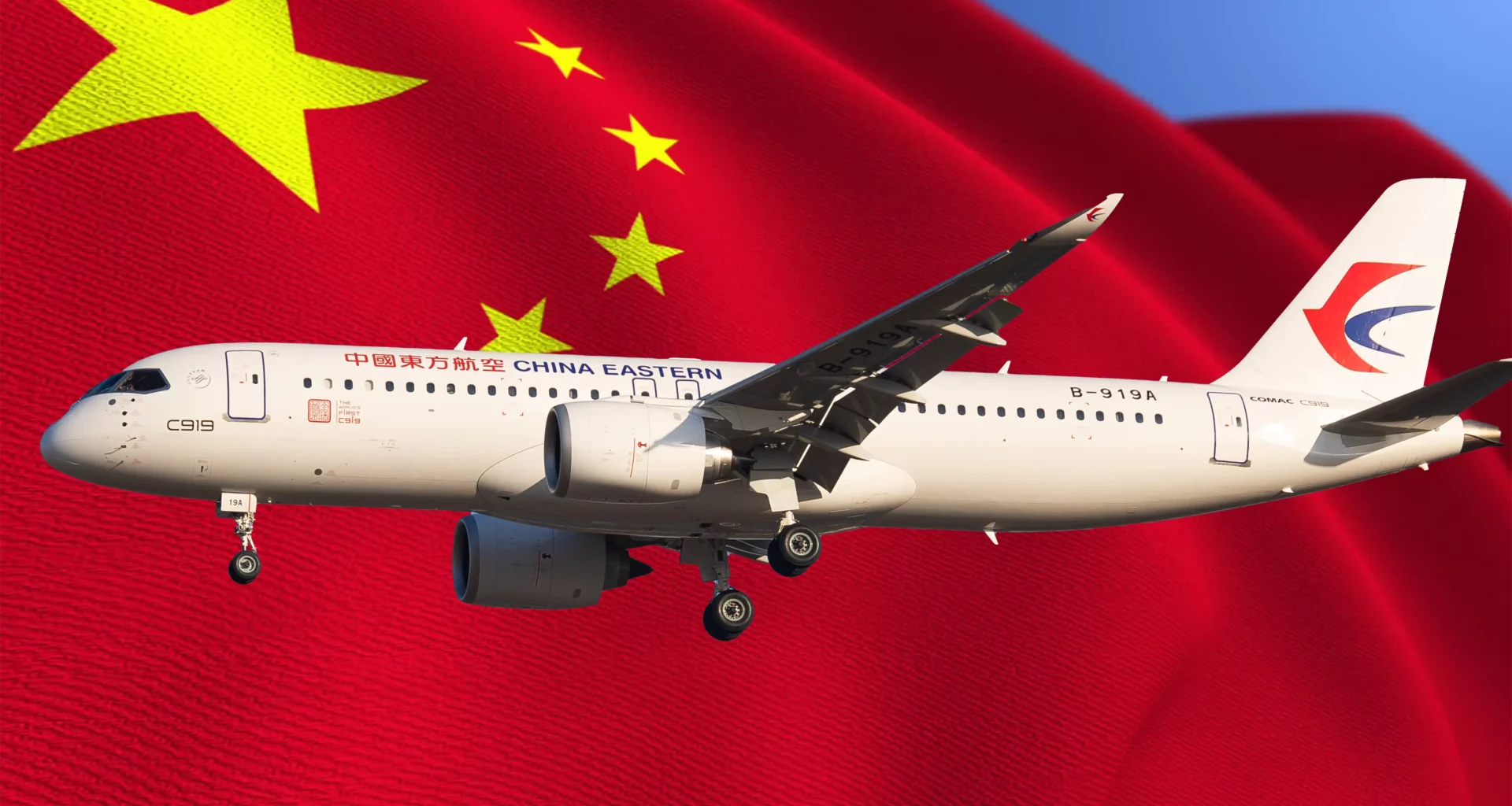

The C919 narrow-body twinjet, built by state-owned commercial aircraft maker Comac, is China’s flagship project to break the Airbus-Boeing duopoly. The plane was specifically built to compete directly with the Airbus A320 and Boeing 737, the world’s two most popular commercial aircraft.

Development for the C919 began in 2008 and production started in December 2011. The first prototype of the C919 was rolled out on November 2, 2015 and made its maiden flight on May 5, 2017. After seven years of testing and certification, the C919 received CAAC (Civil Aviation Administration of China) certification on September 29, 2022.

Though the C919 was assembled in China,calling it “homegrown” might be somewhat of a misnomer since at least 40% of the model’s parts are imported (and experts believe the actual proportion is higher). There’s a long list of foreign suppliers involved in the C919, including Honeywell, GE, CFM Leap, Parker Aerospace, Rockwell Collins, and Michelin.

Comac is actively pursuing FAA and EASA certification

According to Chinese government officials, the CAAC is working closely with the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA) to secure certification of the C919. Securing internationally recognized airworthiness certification is necessary to begin exporting the Comac and, more broadly, is crucially important for global acceptance of Chinese commercial aerospace manufacturing.

“China is investing heavily to improve our aviation standards and showcase domestically built planes like the C919 overseas,” said a CAAC official. “Gaining trust in the quality and safety of Chinese manufacturing is important for the future of our industry.”

Winning orders outside the developing world is unlikely

Even with regulatory approval, the C919 will struggle mightily to win orders outside China and its allies.

As far as I know, the only European or US carrier to have thus far expressed interest is Ryanair, which signed a memorandum of understanding with Comac about a 200-seat C919 in 2011. In 2020, Ryanair’s CEO, Michael O’Leary, confirmed that the deal was still on, though we haven’t heard anything about it since.

Many folks who know a lot more about this subject than I do think that issues around efficiency and maintenance, lack of infrastructure, stigma around Chinese aerospace manufacturing, and geopolitical tension mean the C919 is unlikely to compete directly against market leaders in Europe and North America within the next 15 years.

“The C919 may fly internationally, but will likely be relegated to second or third-tier status for the foreseeable future,” according to analyst Shukor Yusof of Endau Analytics. “Safety concerns and politics rather than performance will determine where this aircraft succeeds.”

On top of all that, Comac has increased the price of the C919 to $108 million such that it’s now more expensive than the $100 million 737 MAX 7. That’s not going to help its chances against Boeing.

Conclusion

While gaining foreign certification for the C919 would be a symbolic win for China’s aerospace ambitions, the aircraft faces huge barriers to competing internationally with Airbus and Boeing. Issues around efficiency, maintenance, infrastructure, and geopolitics mean the C919 will likely be confined to primarily serving Chinese carriers and some smaller regional airlines.

As a general rule, more competition in an industry means more innovation and lower prices, so I’d actually quite like to see Comac make a dent in Boeing and Airbus’s market share. Alas, it seems that China’s aviation influence is destined to remain centered on its (admittedly enormous) domestic market rather than overseas. If Comac does eventually make its way to developed world markets–which is not a sure bet at all–it would likely take several more decades to pose any real threat to the Airbus-Boeing duopoly that has long ruled international skies.

2 comments

At $100 million – no chance. Analysts were expecting more like $50 million. I also don’t believe the weight figures out there. Based on some deep outside analysis COMAC underestimated the difficulty of controlling vibrations while cutting weight and ended up with uncompetitive efficiency numbers. At comparable prices, nobody outside of China or airlines trying to curry Chinese favors will buy the C919.

Plane is super inefficient. Forcing Chinese carriers to pay more for an aircraft that will cost more to operate and maintain is a recipe for bankruptcy unless the state gives it generous subsidies. I’m sure the commitments comac has received from domestic carriers have nothing to do with the CCP.